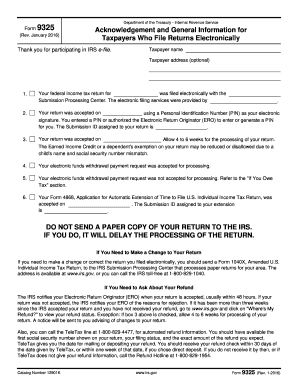

IRS 9325 2017-2026 free printable template

Instructions and Help about IRS 9325

How to edit IRS 9325

How to fill out IRS 9325

Latest updates to IRS 9325

All You Need to Know About IRS 9325

What is IRS 9325?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 9325

What should I do if I discover an error on my IRS 9325 after submission?

If you discover an error after submitting the IRS 9325, you should file a corrected version as soon as possible. Clearly indicate the corrections made and include any necessary explanations in the accompanying documentation. It's important to keep copies of all submitted forms for your records.

How can I verify the status of my submitted IRS 9325?

To verify the status of your submitted IRS 9325, you can use the IRS's online tools or contact their support for specific inquiries. Common reasons for rejection, such as missing information or discrepancies, can also be checked through these channels, helping you to understand the next steps.

Are there special considerations for filing IRS 9325 on behalf of someone else?

When filing IRS 9325 on behalf of someone else, ensure that you have the appropriate power of attorney (POA) documentation in place. This is crucial to legally submit the form and handle any potential communication with the IRS regarding the submission.