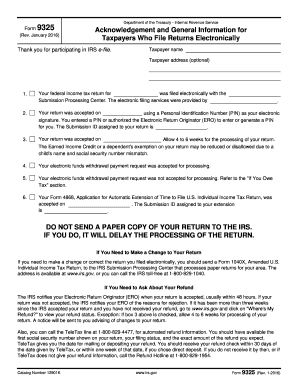

IRS 9325 2017-2025 free printable template

Show details

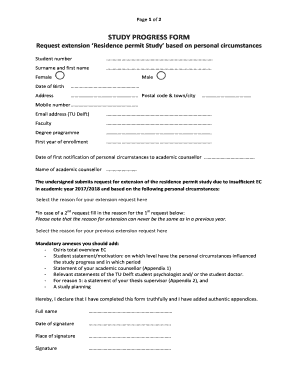

Note EROs can use the Acknowledgement File information translated by the transmitter to complete Form 9325. Catalog Number 12901K www.irs.gov Form 9325 Rev. 1-2017 The IRS uses refunds to cover overdue taxes and notifies you when this occurs. Form January 2017 Department of the Treasury - Internal Revenue Service Acknowledgement and General Information for Taxpayers Who File Returns Electronically Thank you for participating in IRS e-file. Taxpayer name Taxpayer address optional Your federal...

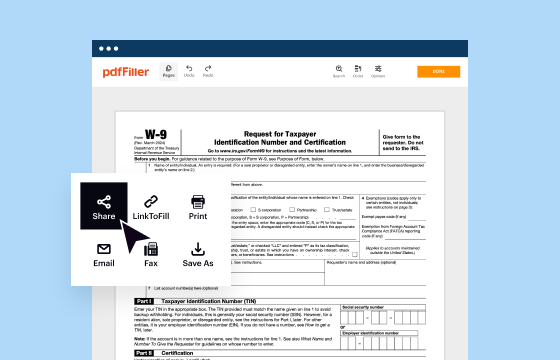

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 9325

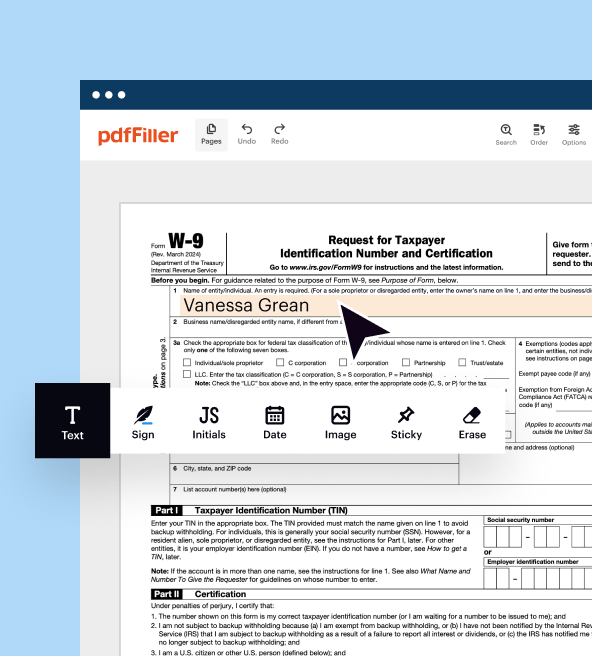

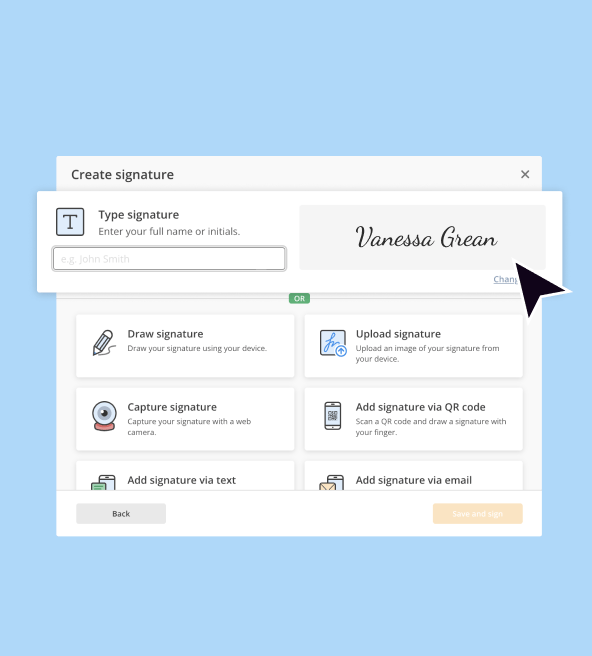

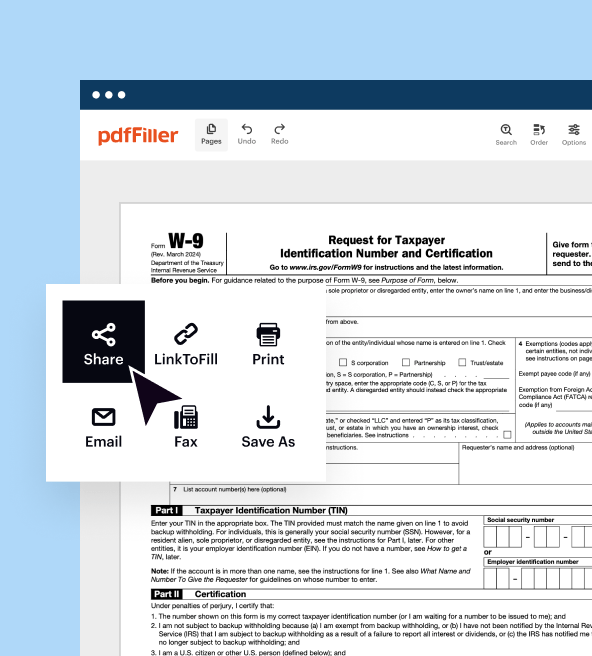

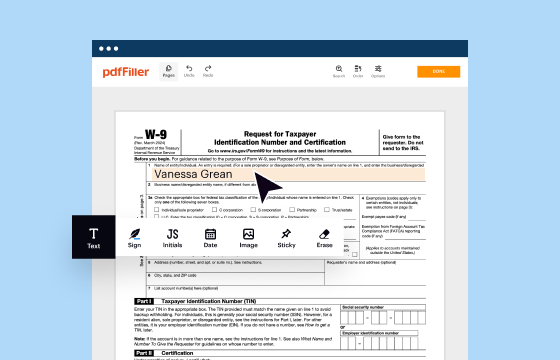

Step-by-Step Instructions for Modifying the Form

Guidelines for Completing IRS Form 9325

Understanding and Utilizing IRS Form 9325

IRS Form 9325, known as the "Acknowledgment and Request for IRS Client Service," serves a critical function in tax preparation. It allows taxpayers to confirm the submission of their tax returns electronically and affirm their compliance with the Internal Revenue Service (IRS) processes. Understanding how to use IRS 9325 effectively can streamline communication with the IRS and ensure your tax filing is on record.

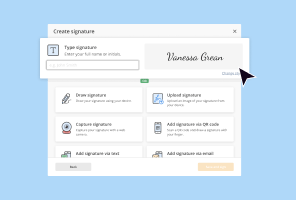

Step-by-Step Instructions for Modifying the Form

Editing IRS Form 9325 is a straightforward process if you follow these steps:

01

Access the most recent version of IRS Form 9325 from the official IRS website.

02

Review the instructions provided for completing the form to understand the requirements fully.

03

Fill in the appropriate fields, ensuring that all information is accurate and concise.

04

Double-check your entries to avoid mistakes that could delay processing.

05

Save the updated form in a secure format, such as PDF, for your records.

Guidelines for Completing IRS Form 9325

To successfully complete IRS Form 9325, follow these key instructions:

01

Input your name, address, and taxpayer identification number in the appropriate sections.

02

Indicate the type of return being submitted (e.g., 1040, 1065) and the tax year involved.

03

Provide the method of submission (e.g., electronically) and the date of submission.

04

Include any relevant attachments if required by the submission guidelines.

05

Verify all details before submitting the form to ensure everything aligns correctly with your filing.

Show more

Show less

Latest Developments and Modifications to IRS Form 9325

Latest Developments and Modifications to IRS Form 9325

Staying abreast of the most recent updates to IRS Form 9325 is essential for compliance. Recent changes include modifications to electronic filing procedures and updates related to submission deadlines imposed by legislative changes. It’s crucial to review any alterations annually during tax season.

Essential Insights into IRS Form 9325's Function and Usage

What Exactly Is IRS Form 9325?

What Purpose Does IRS Form 9325 Serve?

Who Needs to Complete IRS Form 9325?

Conditions Under Which Exemptions Apply

Understanding the Components of IRS Form 9325

Filing Deadlines for IRS Form 9325

Comparing IRS Form 9325 with Other Relevant Forms

Covered Transactions by IRS Form 9325

Number of Copies Required for Submission

Penalties for Non-Compliance with IRS Form 9325 Submission

Required Information for IRS Form 9325 Filing

Additional Forms Typically Accompanying IRS Form 9325

Designated Submission Address for IRS Form 9325

Essential Insights into IRS Form 9325's Function and Usage

What Exactly Is IRS Form 9325?

IRS Form 9325 is a confirmation form utilized by taxpayers to acknowledge their electronic filing submissions. This document serves as an important reference if disputes arise regarding the filing date or completeness of your submission.

What Purpose Does IRS Form 9325 Serve?

The primary purpose of IRS Form 9325 is to provide evidence of the successful electronic filing of tax returns. It helps maintain a transparent record between the taxpayer and IRS, offering peace of mind that submissions are officially documented.

Who Needs to Complete IRS Form 9325?

Primarily, individuals and businesses filing taxes electronically need to complete IRS Form 9325. This includes accountants, tax preparers, and self-filing taxpayers who want to confirm that their returns have been processed.

Conditions Under Which Exemptions Apply

Taxpayers may qualify for exemptions from needing to submit IRS Form 9325 under certain conditions. These may include:

01

Taxpayers whose annual income falls below a specific threshold.

02

Individuals filing forms not requiring acknowledgment or tracking, such as certain state tax submissions.

03

Certain nonprofit organizations that meet qualifying criteria.

Understanding the Components of IRS Form 9325

IRS Form 9325 includes several critical components:

01

Taxpayer's name and contact information.

02

Identification number (SSN or EIN).

03

Type of tax return submitted and the corresponding tax year.

04

Date of electronic submission.

05

Confirmation of the submission method (e-file, etc.).

Filing Deadlines for IRS Form 9325

The IRS does not have a specific filing deadline for Form 9325 itself since it should be submitted along with your tax return. However, ensure that the tax return is filed by the standard deadlines applicable to your situation, typically April 15 for individual taxpayers.

Comparing IRS Form 9325 with Other Relevant Forms

IRS Form 9325 is often compared to Form 8453, which is a declaration and signature for an electronic return. Unlike Form 9325, Form 8453 must be submitted when certain types of IRS documents are needed to validate e-filing, emphasizing the distinct purpose of each form.

Covered Transactions by IRS Form 9325

IRS Form 9325 primarily covers any electronic filing of tax returns. However, specific transactions, such as amendments to previously filed returns or additional supporting documentation requirements, might not be explicitly covered by this form.

Number of Copies Required for Submission

Only one copy of IRS Form 9325 needs to be submitted per electronic filing, as it is typically retained for record-keeping by both the taxpayer and the IRS.

Penalties for Non-Compliance with IRS Form 9325 Submission

Failing to submit IRS Form 9325 when required can lead to various penalties, including:

01

Financial penalties ranging from $50 to $200 depending on the severity of the infraction.

02

Increased scrutiny during audits, leading to potential legal consequences.

03

Delays in processing refunds or possible denial of claims made in the submitted return.

Required Information for IRS Form 9325 Filing

When filing IRS Form 9325, you will need to provide comprehensive details, such as:

01

Your personal identification information.

02

The specific form numbers associated with your tax return submission.

03

The filing submission methods and dates.

Additional Forms Typically Accompanying IRS Form 9325

Depending on your situation, other forms may accompany IRS Form 9325. If you are submitting an e-file with additional documentation, you may be required to include:

01

IRS Form 8453 for declaration and signature.

02

Schedule C if you're a sole proprietor.

Designated Submission Address for IRS Form 9325

As Form 9325 is typically filed electronically alongside the respective tax return, it does not have a physical submission address. Ensure that your electronic transmission is directed to the appropriate IRS e-file location as provided in the filing instructions.

In conclusion, IRS Form 9325 is crucial for all taxpayers engaging in electronic filing. Ensuring compliance not only fosters transparency with the IRS but also safeguards against potential issues. If you need assistance or have questions, consider reaching out for professional support or exploring tools designed for tax document preparation.

Show more

Show less

Try Risk Free